Despite a robust performance by U.S. semiconductor stocks, South Korea’s leading chipmakers, Samsung Electronics and SK hynix, experienced stock declines on April 24, 2025. This downturn occurred even as the Philadelphia Semiconductor Index rose by 3.96%, with companies like Nvidia, AMD, and TSMC posting significant gains.

SK hynix: Strong Earnings Amid Market Volatility

SK hynix reported an impressive first-quarter operating profit of 7.44 trillion won ($5.19 billion), marking a 158% increase year-over-year. This surge was driven by heightened demand for high-bandwidth memory (HBM) chips, essential for AI applications, particularly those supplied to Nvidia. The company’s revenue also rose by 42% to 17.6 trillion won. Despite these strong financials, SK hynix’s stock fell by 1.13% to 174,600 won, influenced by investor concerns over potential demand volatility in the latter half of the year due to macroeconomic uncertainties, including tariff policies .Reuters+1Reuters+1

Samsung Electronics: Facing Challenges in the AI Chip Market

In contrast, Samsung Electronics is grappling with challenges in its semiconductor division. The company reported a 21% drop in first-quarter operating profit, down to 5.2 trillion won ($3.62 billion), attributed to weak AI chip sales and losses in its foundry business. Samsung has lagged behind SK hynix in supplying high-performance memory chips to key clients like Nvidia, leading to reduced demand from Chinese customers for less advanced AI chips. Additionally, falling prices for DRAM and NAND flash chips have further impacted earnings .Financial TimesReuters

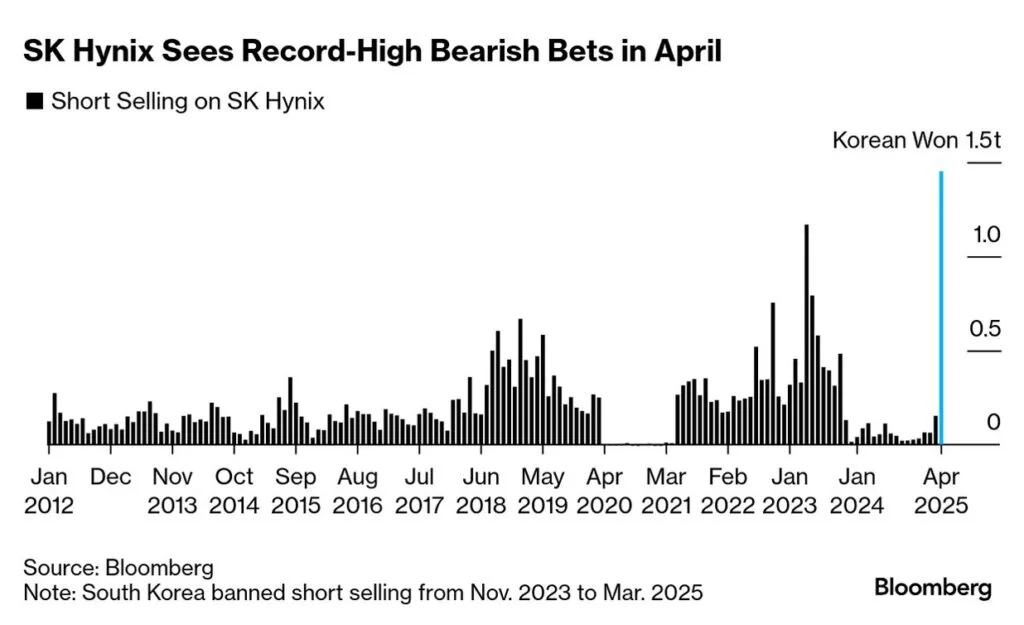

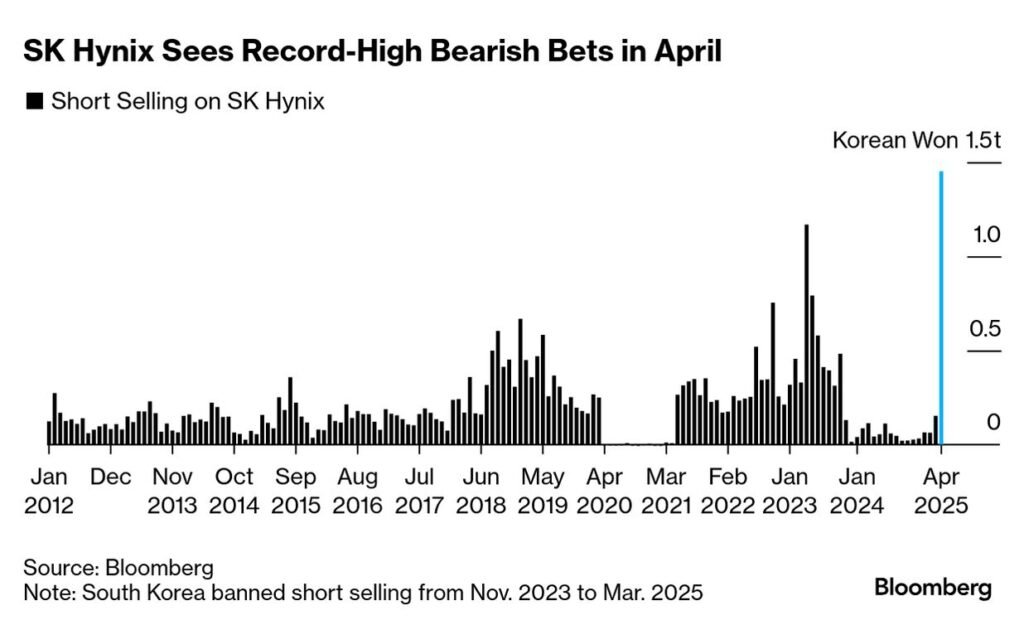

Market Outlook: Navigating Uncertainties

Analysts suggest that the semiconductor industry may be approaching a cyclical peak, with potential downturns ahead. Morgan Stanley recently downgraded its outlook on Korea’s technology sector from “neutral” to “cautious,” citing concerns over excessive supply of HBM chips and reduced target prices for both Samsung and SK hynix. The report highlighted that once the current cyclical boost for DRAM fades, companies like SK hynix may face challenges, especially considering the sharp increase in capital expenditures for DRAM and HBM .

Conclusion

While SK hynix has demonstrated strong financial performance, bolstered by the AI-driven demand for HBM chips, both it and Samsung Electronics face a complex landscape marked by market volatility and macroeconomic uncertainties. Investors and industry stakeholders will need to monitor these developments closely as the semiconductor sector navigates potential cyclical shifts.